Long Home Loan Tenure Might Be Beneficial

HOME LOAN

Long Home Loan Tenure Might Be Beneficial

When it comes to buying a home, individuals nowadays turn to avail a home loan which was not the case until a few decades ago. This is mostly because of increasing urbanization, easy availability of home loans, and higher earnings.

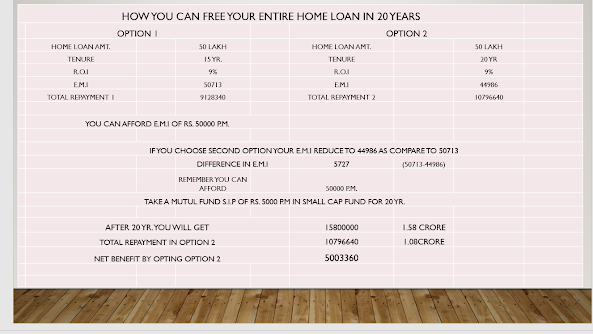

While it is good that individuals are availing of home loans to buy or construct their dream home, it brings us to the question of the loan repayment tenure. In case you avail of a home loan, should you opt for a short tenure or a long one? While many individuals opt for a short one to clear their debts quickly, it is beneficial to opt for a long tenure.

Here, we take a look at the advantages of availing of a home loan with a long tenure. Read on to know more.

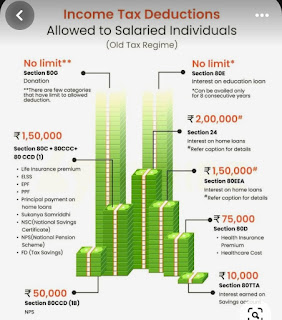

You can avail of income tax benefits – By opting for a long repayment tenure, you can avail of benefits on the interest payment on home loans. Given that there are no alternative tax benefits that are as efficient as that on home loan interests, it is better to avail yourself t for as long as you can. Moreover, you are allowed a deduction of up to Rs.1.5 lakh for repayment of the principal component of a housing loan under Section 80C & you are also allowed a deduction of up to Rs.2 lakh for repayment of interest amount u/s 24 the of the Income Tax Act.

It must be noted that for a short repayment tenure, the principal component will be higher and you will not be able to claim the deduction beyond the specified limit.

There is greater flexibility – Long repayment tenures offer you a lot of flexibility. Irrespective of you taking the home loan under a fixed or floating rate of return, there is no penalty on prepayment. You can opt to prepay the entire loan amount or a part of it in a bid to be free of debts. The option of prepayment without needing to pay a penalty enables you to repay the loan depending on your cash flow.

You can be eligible for a higher loan amount - Another advantage that comes with having a long repayment tenure is that you are eligible for a higher loan amount. Given that, your home loan eligibility is determined by your ability to repay the loan amount in the form of Equated Monthly Instalments (EMIs), a long tenure means a smaller EMI. This is not the case when you opt for a shorter tenure as the borrowed amount will be required to be repaid in large EMIs. Lenders also offer a higher loan amount when you choose a longer tenure and help you in buying a bigger or better house.

Comments

Post a Comment